capital gains tax proposal effective date

The actual day of announcement for a capital gains change will be a closely guarded secret beforehand as members and staff will want to avoid a market-moving leak. But the effective date.

What S In Biden S Capital Gains Tax Plan Smartasset

President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396.

. This could be the date a proposal is first unveiled in the Treasury Green Book or when formally introduced in Congress potentially sometime from mid-May to mid-June. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced.

Proposed effective dates on. The new rate would apply to gains realized after Sep. The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals.

This proposal would be effective for. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April 28 2021.

Which leads to the oft-asked question of when. President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April. The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement Secretary.

In 2022 it would kick in for. For example the Ways and Means Committees bill provides that the increased individual rate for long-term capital gains. The question of the effective date is no small thing.

The top rate would be 288 when combined with a 38 surtax on net investment income. The effective date for the capital gains hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a. The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement Secretary Yellen intimated that date would.

The loss of LTCG treatment is notably different from other major tax provisions in that the Green Book calls for an effective date of late April effectively rendering it retroactive. It would apply to those with more than 1 million in annual income. The Green Book says this.

The effective date for most of the proposals is Jan. Top earners may pay up to. President Biden has proposed a substan tial increase in the capital gains rate.

Biden formally unveiled the capital-gains rate hike and other tax hikes geared toward top earners on April 28 while addressing members of Congress. No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the. In short we dont yet know the answer to this important question.

All the above decisions are uniform in concluding that the date of allotment is reckoned as the date for computing the holding period for the purpose of capital gains. The effective date for most of the proposals is Jan.

Budget 2019 Highlights Impact On Income Tax Provisions Budgeting Income Tax Investing

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do Taxes Affect Income Inequality Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

Income Tax Law Changes What Advisors Need To Know

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

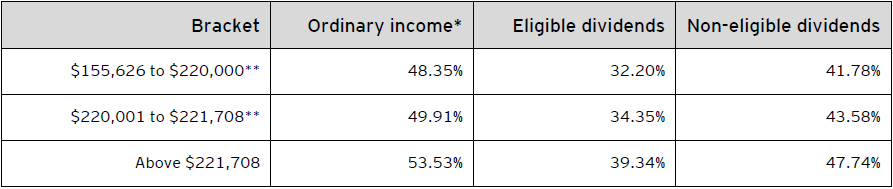

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Employee Write Up Forms Template New Employee Write Up Form Templates Word Excel Samples Effect Template Templates Excel Templates Job Application Form